Finance Flash News – The diamond market in 2024 is facing significant challenges, with prices continuing to decline as the industry grapples with evolving consumer preferences and economic pressures. Recent industry data reveal that the average price of diamonds has fallen by approximately 4% in the first half of the year, dropping from $6,000 per carat in January to $5,750 per carat by June. This decline is notably sharper than the gradual decrease observed in 2023, raising concerns among industry stakeholders.

Diamond Price Comparison: 2023 vs. 2024

The table below illustrates the monthly average diamond prices for the first six months of 2023 and 2024. It highlights the consistent downward trend observed this year compared to the previous year:

| Month | 2023 Prices (USD per carat) | 2024 Prices (USD per carat) |

|---|---|---|

| January | 6,500 | 6,000 |

| February | 6,450 | 5,950 |

| March | 6,400 | 5,900 |

| April | 6,350 | 5,850 |

| May | 6,300 | 5,800 |

| June | 6,200 | 5,750 |

This steady decline in prices reflects a market under pressure, with 2024 prices consistently lagging behind those of 2023.

Analysis of Market Trends

The primary factor behind this price drop is the weakening demand in key Asian markets, particularly in China. Once a major driver of global luxury goods consumption, China’s economic slowdown has led to reduced consumer spending on high-end items, including diamonds. The contraction in the Chinese market has had a ripple effect throughout the global diamond industry, further depressing prices.

Additionally, the rise of lab-grown diamonds is exerting additional pressure on the prices of natural diamonds. These synthetic alternatives are increasingly popular among consumers for their lower cost and environmentally friendly production methods. The demand for lab-grown diamonds has surged, with double-digit growth in sales, particularly among younger generations who are more environmentally conscious. This shift in consumer preferences is challenging traditional producers who are struggling to maintain market share.

Industry Response

In response to these market shifts, major diamond producers are adjusting their strategies. De Beers, one of the industry’s leading companies, has announced plans to reduce its output of raw diamonds to better align supply with the declining demand. The company is also increasing its focus on lab-grown diamonds, recognizing the growing consumer interest in these products. Similarly, Alrosa, another key player in the market, is exploring new markets and adjusting its production strategies to navigate the current challenges.

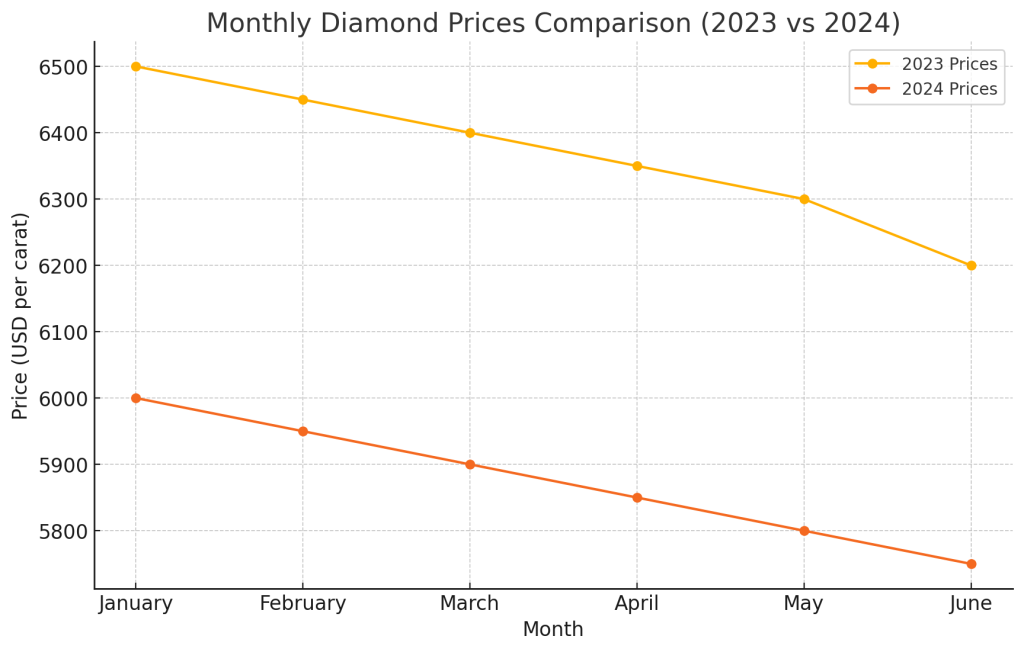

Monthly Diamond Prices: 2023 vs. 2024

The graph below visually represents the monthly average diamond prices for 2023 and 2024. It clearly shows the ongoing downward trend in 2024:

Market Predictions and Outlook

Looking forward, industry analysts suggest that the downward trend in diamond prices may persist throughout 2024, particularly if demand in China and other critical markets does not recover. However, there is some optimism that prices could stabilize later in the year or in early 2025, depending on the broader economic recovery and potential shifts in consumer behavior. A resurgence in demand from regions such as North America and Europe could help support prices, though this will largely depend on overall economic conditions.

The global economic outlook will be a critical factor in determining the future trajectory of diamond prices. Any significant improvement in the global economy, particularly in China, could lead to a rebound in diamond demand and, consequently, prices. Conversely, continued economic challenges may prolong the current period of price declines.

In conclusion, the diamond industry is at a crossroads, facing dual challenges of declining demand and increasing competition from lab-grown diamonds. As the market continues to evolve, companies will need to adapt their strategies to remain competitive in this increasingly complex and challenging environment. Finance Flash News will continue to monitor these developments closely, providing timely updates on price trends and industry shifts as they unfold.