The stock market is in freefall, and investors are scrambling for safe havens. A bear market has gripped the market, fueled by anxieties about recession, inflation reaching 40-year highs, rising interest rates, and geopolitical turmoil. But even amidst this economic turbulence, opportunities exist to keep your investments growing.

This article dives into the world of alternative assets, exploring options like wine, art, and even baseball cards as potential hedges against a declining stock market.

Why Consider Alternative Assets?

Traditionally, investors have relied on a 60/40 portfolio split between stocks and bonds. However, in today’s economic climate, this approach may no longer be sufficient. Here’s why alternative assets deserve a spot in your portfolio:

- Diversification: Unlike stocks and bonds, which can move in tandem, alternative assets offer diversification. This means they can help reduce overall portfolio risk by not following the same boom-and-bust cycles of the stock market.

- Hedge Against Inflation: Physical assets like wine tend to hold their value well during periods of inflation, acting as a buffer against rising prices.

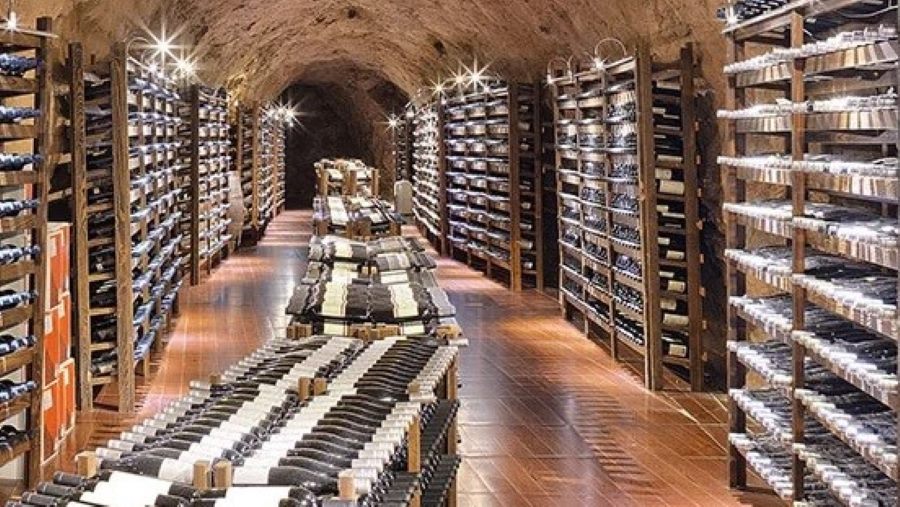

Fine Wine: A Toast to Long-Term Growth

- Appreciation Potential: Fine wine boasts an impressive track record, with the Liv-Ex investables index reporting a 10% compound annual growth rate over the past 30 years.

- Low Correlation to Stocks: Wine prices exhibit relatively low correlation to the stock market, offering protection against stock market fluctuations.

- Tangible Asset: Unlike stocks, fine wine represents a tangible asset you can enjoy. Though, some investors prefer to keep their collections unopened for future appreciation!

Investing in Wine: Uncorking New Opportunities

- Minimum Investment: Companies like Cult Wines offer investment opportunities with a minimum threshold of $10,000.

- Limited Supply, Growing Demand: The finite production of fine wine is contrasted by a growing global demand fueled by rising wealth creation and a burgeoning appreciation for high-quality wines.

- Supply Chain Issues: Shortages can further drive up prices, as seen with the 2021 champagne price surge.

Art: A Luxurious Investment with Staying Power

- High Entry Point: Compared to wine, fine art presents a pricier investment option.

- Delayed Market Response: The art market can exhibit a delayed reaction to the stock market, with a lag of 6 to 18 months. This means a recent economic downturn might not yet be reflected in art prices.

- Lower Price Drops: Art prices typically experience smaller declines compared to stocks during economic downturns.

Investing in Art: Cultivating Your Portfolio

- Market Analysis: Platforms like Masterworks offer investment opportunities in blue-chip art, along with market analysis to guide investors towards informed decisions.

- Historical Performance: Over the period between 1995 and 2021, fine art demonstrated a solid historical performance with a 13.8% annualized appreciation.

Beyond the Basics: Exploring Other Alternative Assets

- Watches: High-end watches from renowned brands like Rolex and Patek Philippe have a reputation for maintaining their value during economic downturns.

- Collectibles: While caution is advised, certain collectibles like sports cards have seen a surge in recent years. Platforms like eBay reported significant growth in sports card trading. However, remember the cautionary tale of Beanie Babies – conduct thorough research before venturing into this area.

Remember: This article is intended for informational purposes only and should not be construed as financial advice. Before investing in alternative assets, conduct your own independent research to make informed decisions