London, August 10, 2024 (CNN) – As global markets grapple with economic uncertainties, investors are turning their attention to the energy sector, weighing the pros and cons of committing their capital in August. With demand for energy remaining robust, particularly in emerging markets, and renewable energy showing strong growth potential, the sector presents both opportunities and risks.

Strong Global Energy Demand

The International Energy Agency (IEA) reports a 2.2% increase in global energy consumption for 2024, driven primarily by emerging markets in Asia and Africa. This steady demand has provided traditional energy companies like ExxonMobil and BP with stable revenue streams, making them attractive for investors seeking reliable returns. The resilience of these companies, even amid fluctuating economic conditions, is a key factor drawing investor interest.

Renewable Energy’s Rapid Growth

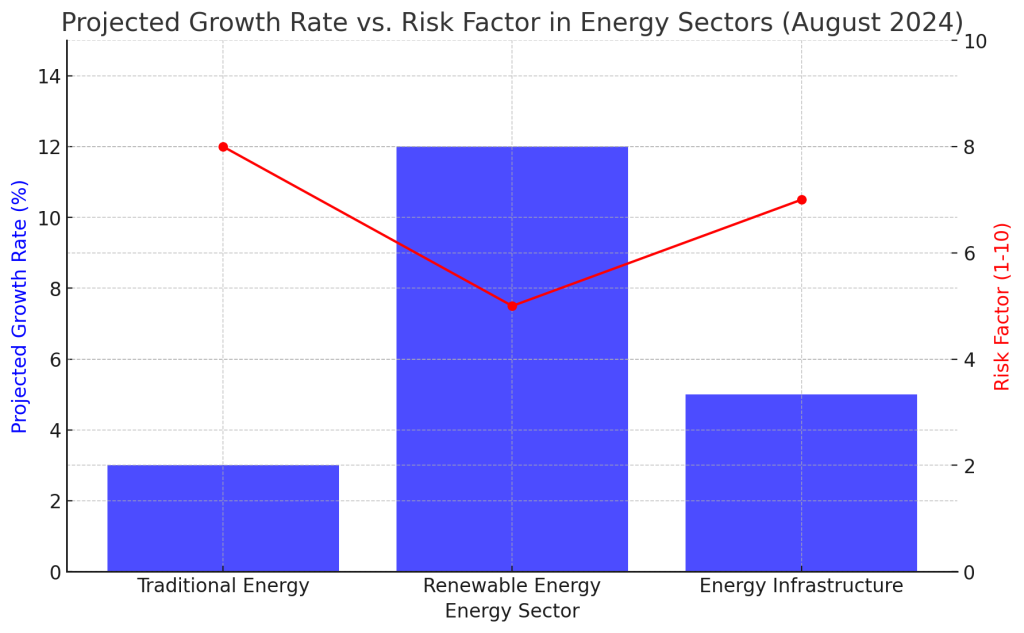

The renewable energy sector continues to expand at a remarkable pace. Global investments in renewables are expected to surpass $1.7 trillion in 2024, marking a 15% increase from the previous year. Solar and wind energy, in particular, are leading this growth, with installed solar capacity projected to reach 1,250 GW by the end of 2024. Companies such as NextEra Energy and Ørsted are at the forefront of this shift, offering significant long-term growth potential. Analysts forecast a 10-12% annual growth rate in the renewable energy sector over the next five years, making it a key area for investors looking to align with sustainability trends.

Geopolitical and Regulatory Challenges

However, the energy sector is not without its risks. Geopolitical tensions, particularly in oil-producing regions, continue to cause significant price volatility. Recent conflicts in the Middle East have already resulted in a 5% increase in crude oil prices in July 2024. Additionally, new environmental regulations, especially in Europe and North America, are expected to increase operational costs for traditional energy companies. For instance, the EU’s carbon border adjustment mechanism (CBAM) is likely to add substantial compliance costs for fossil fuel-dependent industries, potentially squeezing profit margins.

The Investment Outlook for August 2024

Given the current landscape, a diversified approach to investing in the energy sector appears prudent. While traditional energy companies offer stability due to high global demand, the rapid growth in renewables presents a compelling case for long-term investment. The key is to balance the risks of volatility and regulatory pressures with the potential for stable returns and growth.

As August progresses, investors should remain vigilant, closely monitoring geopolitical developments and regulatory changes. With careful selection of stocks and strategic timing, the energy sector could offer lucrative opportunities even in these uncertain times.